When you take a pill for high blood pressure or an antibiotic, chances are it was made in China or India. These two countries produce over 80% of the world’s active pharmaceutical ingredients (APIs) and nearly half of all generic drugs sold in the U.S. But here’s the thing: manufacturing quality isn’t the same in both places - and the FDA knows it.

Why FDA Monitoring Matters More Than You Think

The FDA doesn’t just inspect drug factories for fun. Every inspection is a checkpoint between you and a potentially dangerous medicine. In 2023, 37% of Chinese pharmaceutical facilities faced import alerts from the FDA - meaning the agency blocked shipments because of safety violations. In contrast, only 18% of Indian facilities got flagged. That’s not a small difference. It’s the difference between a drug being safe to take and being pulled off shelves. These alerts aren’t just paperwork. They’re red flags for things like dirty equipment, falsified test results, or poor storage conditions. In one case, a Chinese plant was found to be using unapproved solvents to clean machinery - a practice that can leave toxic residues in pills. Indian plants, while not perfect, have fewer of these issues because their compliance systems are built into daily operations.India’s Edge: Compliance Built Into the System

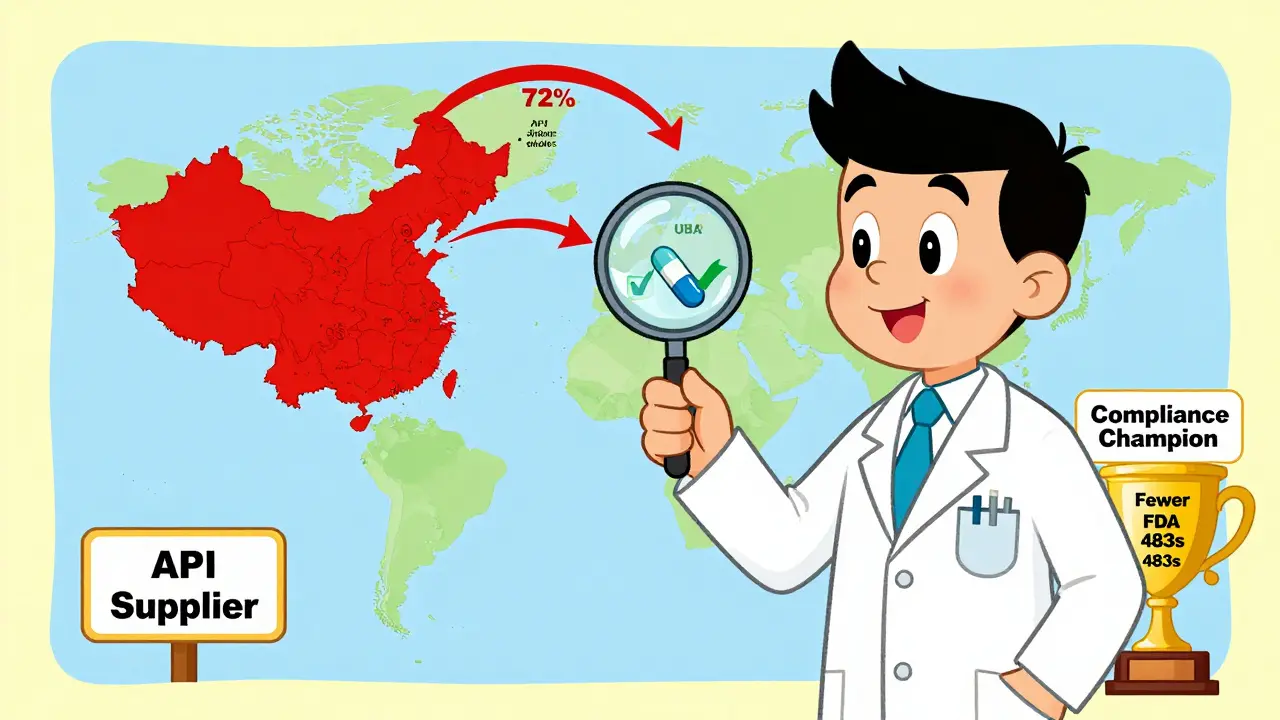

India has over 100 FDA-approved drug manufacturing plants. China has 28. That’s not a typo. India leads by more than 250% in certified capacity. Why? Because India’s pharmaceutical industry learned early that compliance isn’t optional - it’s the price of entry to Western markets. Companies like Dr. Reddy’s, Sun Pharma, and Cipla didn’t just build factories; they built quality cultures. They trained staff on FDA 21 CFR Part 211 regulations. They installed digital monitoring systems to catch errors before they reach the bottle. Bain & Company’s 2024 report found that Indian manufacturers use digital tools to eliminate human mistakes across production lines - something still rare in many Chinese plants. FDA inspection reports from 2020 to 2023 show Indian facilities received 30% fewer Form 483 observations - the official notices of violations - than Chinese ones. That’s not luck. It’s systemic.China’s Scale vs. China’s Risk

China makes more APIs than anyone else. It controls roughly 80% of the global supply of raw ingredients for common drugs like antibiotics, blood pressure meds, and painkillers. That’s power. But power comes with risk. China’s manufacturing ecosystem is massive, centralized, and cost-driven. Many factories are owned by state-backed conglomerates focused on output, not oversight. Smaller suppliers - who make up a big chunk of the market - often lack the resources to meet international standards. The result? Inconsistent quality. The FDA has responded by ramping up inspections and import restrictions. In 2023, nearly 4 out of 10 Chinese facilities were under some form of regulatory watch. That’s why global drugmakers are shifting. The “China+1” strategy isn’t a buzzword - it’s a survival tactic. Companies are adding India as a backup to avoid being stuck if a Chinese plant gets shut down.

The Hidden Problem: India Depends on China

Here’s the twist: India, despite its compliance strengths, is deeply dependent on China. In 2024, 72% of India’s bulk drug ingredients - the raw materials for its generics - came from China. That’s up from 66% just two years earlier. Think of it like this: India builds the medicine, but China builds the engine. If China cuts off supply - whether for political reasons, a factory shutdown, or a quality failure - India’s entire export machine could stall. One U.S. pharmaceutical sourcing executive told Bain & Company: “We’re trying to fix a single point of failure in our supply chain.” That’s why India’s government is pouring $3 billion into production-linked incentives (PLIs) to boost domestic API manufacturing. The goal? Reduce that 72% dependency to under 40% by 2030. It’s a race against time.What Happens When You Choose One Over the Other?

If you’re a drugmaker deciding where to outsource:- Choose India if you need reliable compliance for U.S. or EU markets. You’ll pay slightly more, but you’ll avoid costly recalls, FDA delays, and reputational damage. Your audit schedule will be lighter, and your supply chain will be more predictable.

- Choose China if you’re making low-cost drugs for markets with looser regulations. You’ll save on price - but you’ll need to do more testing, more inspections, and more oversight yourself. It’s cheaper upfront, riskier long-term.

The Future: Who Wins?

India’s export potential is massive. Bain & Company projects its pharmaceutical exports could hit $350 billion by 2047 - up from $27 billion today. That growth hinges on two things: reducing API imports from China and moving into higher-value products like biosimilars and cell therapies. China’s future is more uncertain. While it’s investing heavily in biopharmaceuticals - with a projected 19.3% annual growth rate in that sector - its generic API dominance is eroding. By 2030, its share of the global outsourced pharma market could drop from 25% to 15%. Meanwhile, India is expected to pick up 20-30% of that lost share. The real winner? The patient. As supply chains become more resilient and quality improves, fewer people will get sick from bad medicine. That’s the goal.What You Should Know as a Consumer

You don’t need to know where your pill was made. But you should know this: if your medicine is a generic, it’s likely from one of these two countries. And the difference in quality matters. The FDA doesn’t guarantee every pill is perfect - but it does guarantee that drugs from compliant factories get tested more often. If your drug comes from a company that sources from India, it’s statistically more likely to meet U.S. safety standards. Don’t assume “Made in India” means better. Don’t assume “Made in China” means worse. But do know that the system behind the label - the inspections, the regulations, the quality checks - is what really decides if your medicine is safe.Why does the FDA inspect drug factories in China and India?

The FDA inspects foreign drug factories because over 80% of the active ingredients in U.S. medicines come from outside the country. These inspections ensure that drugs meet the same safety and quality standards as those made in the U.S. Without these checks, contaminated, ineffective, or improperly labeled drugs could reach American patients.

Is Indian-made medicine safer than Chinese-made medicine?

On average, yes - but it depends on the manufacturer. Indian facilities have fewer FDA violations and more approved plants than Chinese ones. In 2023, only 18% of Indian drugmakers faced import alerts compared to 37% of Chinese ones. That’s because Indian companies have spent decades aligning with U.S. and EU standards. But not all Indian factories are equal - and some Chinese plants are now meeting high standards too.

Why does India rely on China for drug ingredients?

India has focused on turning imported raw materials into finished generic drugs - a high-value, low-cost business model. China, meanwhile, became the world’s lowest-cost producer of APIs. It’s cheaper and faster for Indian companies to import APIs from China than to build their own large-scale production. But this creates risk: if China cuts off supply, India’s drug exports could collapse.

What is the "China+1" strategy in pharma manufacturing?

The "China+1" strategy means companies avoid putting all their manufacturing eggs in one basket. Instead of relying only on China, they add a second country - usually India - as a backup. This reduces supply chain risk. If a Chinese factory shuts down due to an FDA alert or political tensions, companies can switch production to India without losing output.

Are biosimilars better made in China or India?

China currently leads in biopharmaceutical production, with a 19.3% annual growth rate in that sector since 2015. India is catching up fast, with its biosimilars market projected to hit $12 billion by 2025. But China still has the edge in complex biologics because of its heavy state investment in R&D. India’s strength is in making these drugs cheaper and faster - if it can reduce its dependence on Chinese raw materials.

John O'Brien

Yo I just took my blood pressure med this morning and I had to double check the bottle because I read this article and now I’m paranoid

Paul Taylor

Look I get it India’s got better compliance numbers but lets not ignore the fact that China’s been upgrading fast like crazy in the last five years and a lot of those FDA alerts are from small mom and pop shops that shouldn’t even be exporting anyway the big players like Sinopharm and CSPC are now ISO certified and have real QA teams not just guys with clipboards

Also the whole narrative that India’s some golden child of pharma ignores how they’re still 72% dependent on China for APIs which is wild if you think about it they’re building houses on sand and pretending the foundation’s solid

And don’t even get me started on how the FDA’s inspection process is biased toward English speaking countries and the language barrier in China means a lot of violations get misreported or exaggerated

Plus the cost difference is insane you think a US company is gonna pay 30% more for Indian made pills when they can get the same thing from China for half the price if they do their own batch testing

And honestly the idea that patients are safer because it’s made in India is just marketing BS the pill doesn’t care where it was made it cares if the batch passed QC and that’s something you can do anywhere if you’re serious about it

I’ve worked in pharma logistics for 12 years and I’ve seen plants in both countries that are spotless and plants that look like they were built in a garage

The real problem isn’t geography its corporate accountability and the fact that most generic manufacturers are squeezed to the bone by insurance companies and PBMs so they cut corners wherever they can

So blaming China or India is just distracting from the real issue which is that our entire drug pricing system incentivizes risk not safety

And don’t even get me started on how the FDA only inspects like 5% of foreign facilities each year so the stats they publish are basically lottery numbers

Also the whole China+1 thing is just a hedge not a solution if you’re really serious about supply chain resilience you need to bring some API production back to the US or EU not just swap one foreign supplier for another

And why is no one talking about the fact that India’s PLI scheme is mostly just corporate welfare with zero transparency on who’s actually getting the money

And the biosimilars thing is a red herring China’s got way more experience in biologics manufacturing and their R&D spending is triple India’s

So yeah India’s got better compliance scores but that doesn’t mean they’re the answer and China’s not the villain

It’s all just a complex mess of economics politics and corporate greed and we’re pretending we can solve it with country flags