When a brand-name drug loses its patent, you’d expect prices to drop fast-thanks to generic competitors stepping in. But sometimes, the brand company itself launches a cheaper version of its own drug. That’s not a mistake. It’s an authorized generic.

These aren’t knockoffs. They’re the exact same pills, made in the same factory, under the same FDA approval as the original brand. The only difference? They’re sold without the brand name on the label. And they’ve become a quiet but powerful tool in how drug companies manage the shift from monopoly pricing to generic competition.

What Exactly Is an Authorized Generic?

An authorized generic is a version of a brand-name drug that the original manufacturer produces and sells under a generic label. It’s not approved through the traditional Abbreviated New Drug Application (ANDA) process like other generics. Instead, the brand company simply licenses its own drug to a distributor or subsidiary and relabels it. The FDA has tracked these since 1999, and since 2010, over 850 have entered the market.

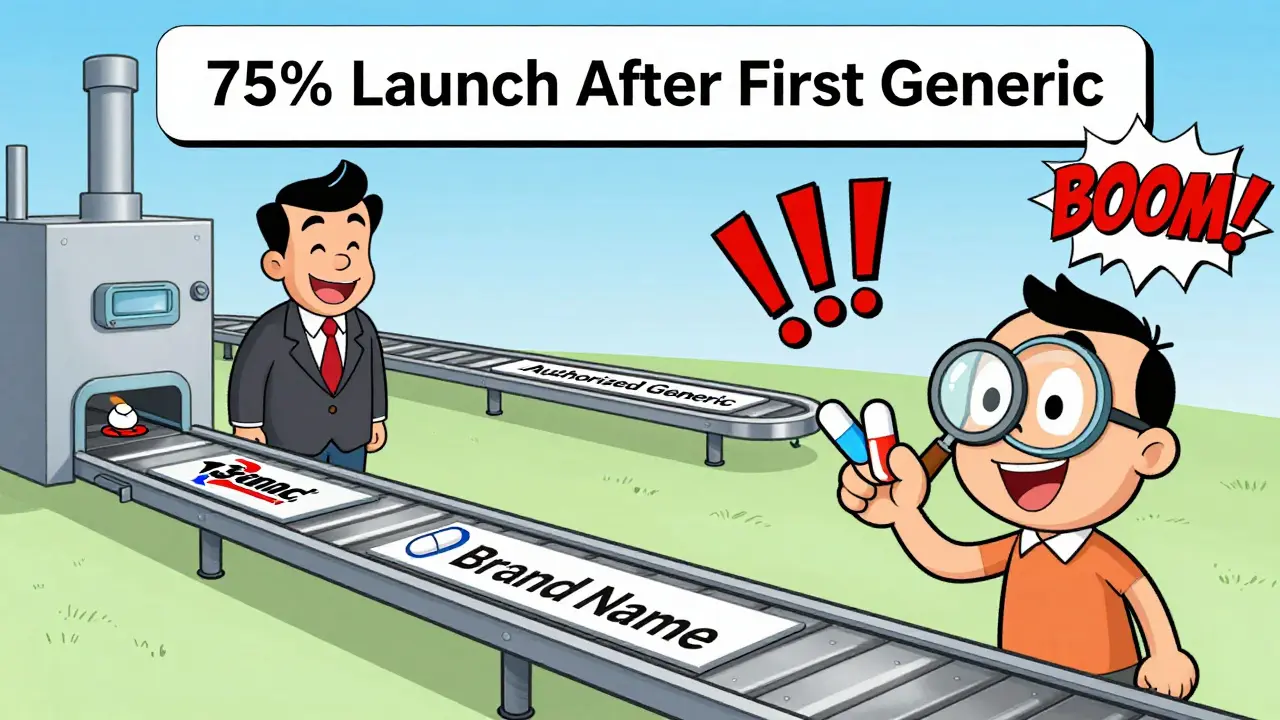

Why does this matter? Because it gives the brand company control over when and how generics enter. If they wait too long, a competitor might grab market share. If they launch too early, they risk killing their own profitable brand. So timing is everything.

Between 2010 and 2019, 75% of authorized generics launched after the first traditional generic was approved. That means brand companies weren’t trying to beat generics-they were trying to compete with them. And they did it by undercutting their own brand price, but keeping the product identical.

Why Do Brand Companies Use Authorized Generics?

It’s a smart business move. When a drug’s patent expires, revenue can drop 80% or more within a year. Authorized generics help soften that fall.

Instead of letting a third-party generic company capture the entire low-price market, the original manufacturer steps in. They keep the production line running, maintain quality control, and still earn revenue-just at a lower margin. It’s like saying, “I’ll let you buy my drug cheaper, but I’m still the one selling it.”

This tactic is especially common in markets where the first generic competitor gets 180 days of exclusivity under the Hatch-Waxman Act. In those cases, about 70% of authorized generics launched before or during that exclusivity window. That’s not random-it’s calculated. The brand company is trying to block the generic from dominating the market during its most valuable period.

Oral solid drugs-tablets and capsules-are the most common targets. Why? Because they’re easy to copy. The chemistry is simple, the manufacturing is standardized, and the FDA approves ANDAs for them faster. That’s why over 60% of authorized generics are oral solids, even though they only make up about 40% of all at-risk drugs.

Market Trends: The Shift Away from Delayed Launches

For years, brand companies would sit on authorized generics, waiting months or even years after the first generic entered the market. That strategy was meant to protect brand sales as long as possible. But that’s changing.

According to RAPS in June 2025, the practice of delaying authorized generic launches is declining. Why? Two big reasons: regulatory pressure and market reality.

Regulators are watching more closely. Policymakers are pushing back against tactics that delay price drops. Patients and payers are demanding faster access to affordable drugs. And with over $200 billion in brand drug sales set to lose exclusivity between 2025 and 2030, companies can’t afford to play games.

Instead of holding back, more manufacturers are launching authorized generics sooner-sometimes even before the first traditional generic hits the market. It’s not about holding onto profits anymore. It’s about staying relevant.

The Bigger Picture: Generic Market Growth and Biosimilars

The U.S. generic drug market is growing fast. It hit $138 billion in 2024 and is projected to reach $197 billion by 2034. That growth isn’t just from tablets-it’s from blockbuster drugs losing patents.

Drugs like ustekinumab and vedolizumab, which brought in billions annually, are now open to biosimilar competition. That’s a $25 billion opportunity by 2029 in just two therapeutic areas. And while biosimilars are technically different from small-molecule generics, the same market logic applies: lower prices, more access, and brand companies trying to stay in the game.

Authorized generics are part of this larger shift. They’re not going away-they’re evolving. As more complex drugs come off patent, brand manufacturers will need to adapt. The old model of waiting to launch a generic version won’t work anymore. Patients, payers, and regulators won’t allow it.

FDA’s New Pilot Program: What It Means for Authorized Generics

In October 2025, the FDA announced a pilot program to fast-track ANDA reviews for drugs made entirely in the U.S.-from raw ingredients to final packaging. This is a game-changer.

For traditional generic manufacturers, this means faster approvals and lower costs. For brand companies considering authorized generics, it means a new incentive: if you make your generic version in America, you might get your product to market quicker.

That could lead to more authorized generics, especially for drugs where supply chain security is a concern. It also blurs the line between traditional generics and authorized ones. If both are made in the U.S. and get faster approval, the distinction becomes less about who makes it-and more about how it’s labeled.

This isn’t just about manufacturing. It’s about trust. Patients want to know their medicine is safe, reliable, and affordable. If the FDA rewards U.S.-made drugs with faster access, that’s a signal to the whole industry: domestic production is the future.

Regulatory Scrutiny and the Push for Transparency

The FDA’s authorized generic listing system is manual. Companies submit annual reports. The agency reviews them. It’s not automated. And that’s led to delays, inconsistencies, and confusion.

Experts from the JAMA Health Forum warn that when authorized generics are used to delay competition, they cost patients and payers billions. One study estimated that just three drugs-imatinib, celecoxib, and another-added $5 billion in excess spending over three years after patent expiration because authorized generics were held back.

But here’s the twist: when authorized generics launch on time, they can actually help drive prices down. They create competition where none existed. They force traditional generics to lower their prices too. And they give pharmacies and insurers more options.

The real question isn’t whether authorized generics are good or bad. It’s whether they’re used responsibly. As regulatory scrutiny increases, companies that use them to manipulate markets will face backlash. Those that use them to improve access? They’ll thrive.

What’s Next for Authorized Generics?

The future isn’t about hiding authorized generics. It’s about using them openly.

As more high-cost drugs lose exclusivity, brand manufacturers will need to act fast. Waiting for a competitor to steal your market won’t work anymore. Launching an authorized generic early, making it in the U.S., and pricing it competitively? That’s the new playbook.

It’s also about trust. Patients don’t care if a pill is branded or generic. They care if it works and if they can afford it. Authorized generics, when used ethically, give both.

The market will keep growing. The pressure to lower prices will keep rising. And authorized generics? They’re not going to disappear. They’re going to become a normal, expected part of how drugs reach patients after patent expiration.

The companies that get this right will win. The ones that cling to old tactics? They’ll be left behind.